Specialty lines of insurance have been an increasingly important and profitable sector of the industry. These unique insurance products cover risks that are not typically addressed by standard insurance policies, and they require a different skill set and approach from insurance professionals. To unlock the secrets behind successful specialty lines, it’s important to gain insights from industry leaders who have excelled in this space.

One of the key factors contributing to the success of specialty lines is the ability to identify and understand niche markets. Specialty lines can encompass a wide range of insurance products, including cyber liability, professional liability, and environmental liability, just to name a few. To effectively serve these markets, insurance professionals must have a deep understanding of the specific risks and challenges faced by the targeted industries.

Industry leaders emphasize the importance of building strong relationships with clients and underwriting partners in specialty lines. This involves gaining a deep understanding of the unique needs of each client and developing tailored solutions to address their risks. By cultivating strong partnerships with underwriters, insurance professionals can gain access to specialized expertise and unique products that are essential for success in the specialty lines market.

Another key aspect of successful specialty lines is the ability to adapt and innovate in response to changing market conditions. As the risk landscape evolves, insurance professionals must be proactive in developing new products and coverages to address emerging risks. This requires a willingness to invest in research and development, as well as a nimble approach to product design and underwriting.

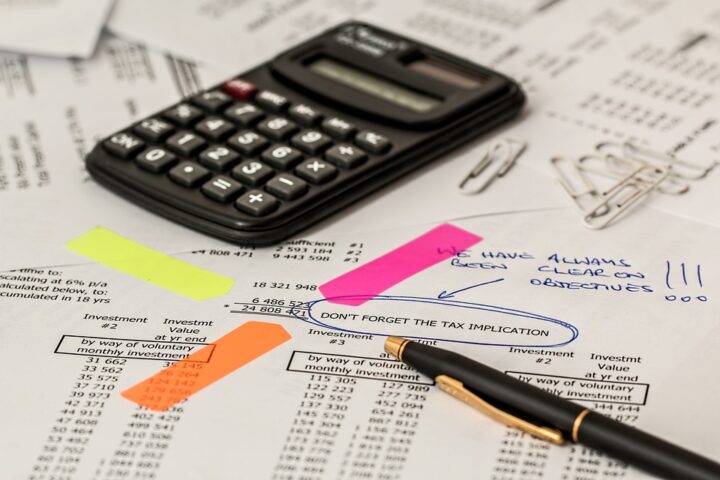

Additionally, industry leaders stress the importance of leveraging data and analytics to inform decision-making in specialty lines. By harnessing the power of data, insurance professionals can gain deeper insights into the risks and opportunities within specialty lines markets. This can enable more accurate pricing, improved underwriting decisions, and enhanced risk management strategies.

Finally, successful specialty lines require a commitment to excellence in customer service and claims management. Clients in specialty lines often face complex and high-stakes risks, and they rely on their insurance providers to deliver responsive and effective support in the event of a claim. Industry leaders emphasize the importance of building a claims team with specialized expertise in the unique risks covered by specialty lines products, as well as a commitment to delivering exceptional service to clients.

In conclusion, successful specialty lines require a combination of deep industry expertise, strong relationships with clients and underwriters, a commitment to innovation, and a focus on data-driven decision-making. By learning from industry leaders who have excelled in specialty lines, insurance professionals can gain valuable insights into the secrets of success in this unique and profitable sector of the insurance industry.